Reserve Your KS Tax Credit

We are currently seeking non-binding commitments from donors interested in reducing their KS State Tax liabilities.

Take advantage of this incredible opportunity!

To secure your opportunity for Kansas Tax Credits, please send your non-binding commitment via email to megantodd@mygoodlife.org or amyunmacht@mygoodlife.org to be added to our list!

Reduce your Kansas Tax Liability & Make a Meaningful Difference in the lives of individuals with disabilities in Kansas.

In past years, the support of our incredible donors has helped us raise more than $600,000 to expand GoodLife's powerful impact on the community.

Secure My Tax Credits

How Does It Work?

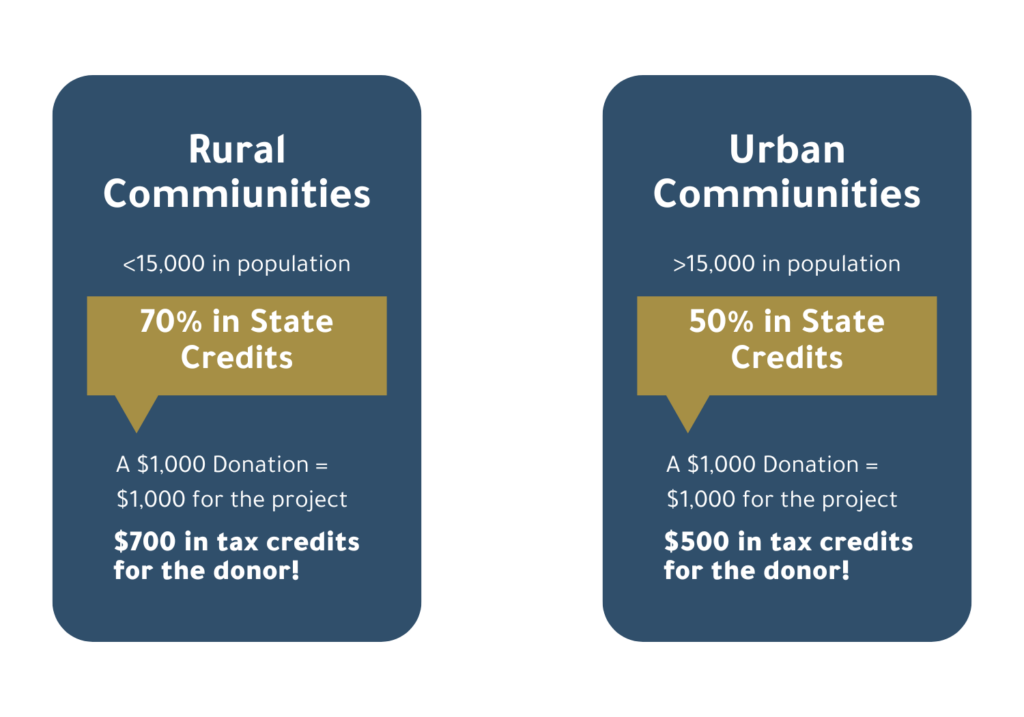

Businesses and individuals subject to Kansas income tax are eligible to receive a 70% or 50% tax credit through this program. Donations must be $250 or greater and the payment should come directly from the business or the individual.

State tax credits reduce the total amount of taxes owed to the state. They are a way for a taxpayer to substantially reduce the cost of making a contribution to a charitable organization.

(Note: GoodLife Innovations cannot provide tax advice. Please consult a tax professional with questions about your specific situation.)